SUMMARY: Cytonn , a Kenyan investment firm, took in billions of shillings from regular investors, invested the money in ways that weren’t properly protected, and now the courts have stepped in to recover whatever can be saved.

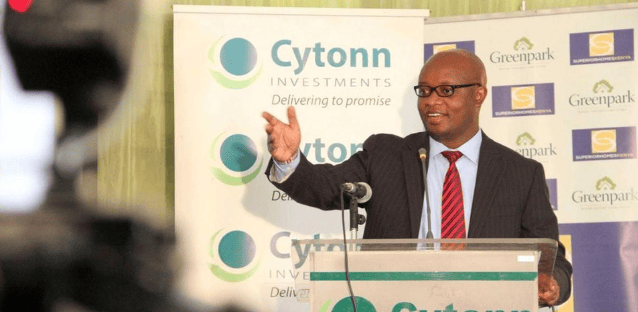

Edwin Dande, Managing Partner and CEO of Cytonn Investments Managing Limited (Image credit: Business Daily)

In this article:

A Brief History of Cytonn’s Troubles

How This Affects Engineers & Contractors

Key Takeaway

A BRIEF HISTORY OF CYTONN’S TROUBLES

Before the collapse, Cytonn Investments was a well-known Kenyan firm that let people invest in real estate for high returns.

Kai Mykkänen, Finnish Minister of Foreign Trade & Development, at Cytonn Investments on November 18, 2016, shaking hands with a company representative. (Image credit: Cytonn Investments)

For many ordinary Kenyans, investing felt complicated, intimidating, or out of reach.

However, Cytonn presented a clear, confident, and simplified gateway, with the added appeal of being able to “see” where your money was going.

They positioned themselves as the bridge between everyday Kenyans and sophisticated investment opportunities, especially in real estate.

That trust helped them pull in over KSh 11 billion from more than 3,000 investors.

But behind the sleek marketing, not everything was as it seemed.

Much of the money investors trusted Cytonn with didn’t stay in safe, separate accounts. Instead, it flowed into a web of smaller companies called Special Purpose Vehicles (SPVs).

These SPVs were still controlled by insiders at Cytonn.

The two main products involved were:

CHYS (Cytonn High Yield Solutions)

CPN (Cytonn Project Notes)

These were supposed to invest safely in property projects. But because Cytonn controlled the SPVs, there was no real separation between investor money and the company’s own activities.

When projects hit snags or cash flow slowed, the structure became unstable, putting billions of shillings at risk.

The Ridge, one of Cytonn’s real estate developments currently under administration. (Image credit: Cytonn Real Estate)

The courts later described this setup as “akin to fraud”.

Not criminal fraud, but a system where investor money wasn’t handled in the way they had been led to believe, and there was no proper protection for it.

To protect investors, the courts ordered liquidation of Cytonn’s funds and placed the SPVs under independent administration.

An administrator now controls the assets, selling what can be recovered to try to return funds to investors.

The company has said that only the two products mentioned (CHYS and CPN) are being liquidated and all their other businesses are still financially healthy. They explain that the problems happened because COVID-19 caused projects to stall and cash to run short.

HOW THIS AFFECTS ENGINEERS & CONTRACTORS

Cytonn didn’t build the developments themselves. They acted as the developer and financier for these real estate projects, then hired engineers, contractors, project managers, and consultants to execute the work on the ground.

Applewood, one of Cytonn’s real estate developments currently under administration. (Image credit: Cytonn Investments)

For example, for projects now under administration (such as Taraji, Applewood, and The Ridge) Cytonn:

Raised money from investors to fund development

Contracted construction teams to deliver the buildings

Managed cash flow and payments to these professionals

This means engineers and contractors were suppliers of labor, design, and project execution, while Cytonn was the client and the source of funds.

Now, with the SPVs under independent administration, these professionals are facing challenges:

1. Payment delays or non-payment

Funds tied up in the SPVs may not be released quickly, which could delay payments for work already completed.

2. Project uncertainty

Projects linked to CHYS/CPN may stall or slow down as the administrator prioritizes asset protection and legal compliance. Contractors and engineers may need to renegotiate timelines or scope.

3. Reputation risk

Being associated with a highly publicized “financially troubled” project can affect a contractor’s credibility unless their role is clearly documented and their performance is demonstrably separate from the client’s financial issues.

KEY TAKEAWAY

Cytonn’s collapse is a key lesson in risk management, showing that construction projects aren’t only about engineering, they’re also complex financial ecosystems..

Taraji, one of Cytonn’s real estate developments currently under administration. (Image credit: Cytonn Investments)

Unfortunately, even flawless engineering cannot survive unstable financing. To protect themselves, contractors and consultants should ensure contracts include safeguards such as:

Escrow or secure payment structures

Staged payments tied to verified progress

Lien rights or other legal protections

When the money behind a project is shaky, everything on site becomes vulnerable — no matter how well-designed or well-executed the work is.